Working Capital

Working capital is the difference between a company’s current assets and current liabilities, reflecting its short-term operational liquidity

5 Star Rating on Google

Why Choose Working Capital?

Working Capital Loans allow businesses to leverage cash flow and receivables for low-cost financing.

Payback terms are customizable, and each business owner can control the cost of capital by selecting a term that best suits their business.

Early payoff incentives are included to ensure that we maximize your ROI and minimize your cost of capital.

Needed Documents for a Working Capital Loan:

Consecutive 3 months of Most Recent Bank Statements

Completed Verification Form

Government Issued ID for Verification

What are the requirements for a Working Capital Loan?**

1 Year

in business

Business

bank account

$10K

per month in deposit volume

What makes a Working Capital Loan seamless?

Minimal paperwork required

No hard credit pulls

No Collateral Required

Funding process takes 24 – 48 hours

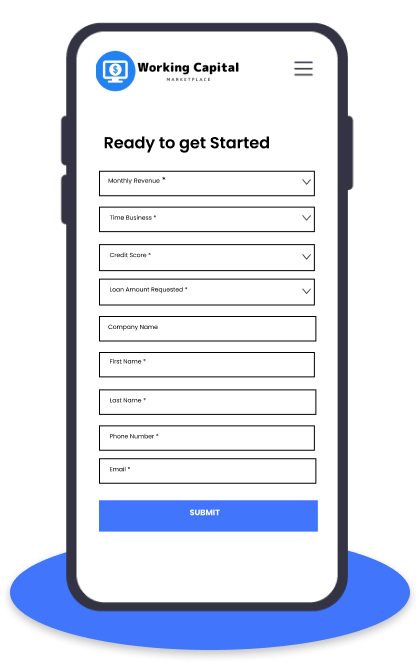

Applying for a Working Capital

Traditionally speaking, banks tend to have a labor-intensive process when applying for term loans. The Working Capital Marketplace ensures a simplified and streamlined process to deliver an approval within 48 hours.

Apply Online

Fast & Easy Online Application Get your Quote today

Review Your Options

Get connected with a Funding Manager dedicated to you, to review and customize options.

Get Funded

Your Funds will usually be sent same day viawire or ACH

Reviews

What Customers Say?