Company Acquisition Loans

Acquiring an existing business can be a game-changing move for entrepreneurs and established business owners alike. However, the financial aspects of a business acquisition can be complex and challenging. That’s where The Working Capital Marketplace steps in to simplify the process and offer a range of funding options to make your acquisition dreams a reality.

5 Star Rating on Google

Business Acquisition Loans

Business acquisition loans are specialized financing solutions designed to help you purchase an existing business. These loans can cover various aspects of the acquisition, including the purchase price, working capital, inventory, and more. Here’s what you need to know about our business acquisition loans:

Customized Financing

We understand that every acquisition is unique. That’s why our business acquisition loans are tailored to your specific needs, ensuring you get the funding required to make the acquisition a success.

Expert Guidance

Our team of experienced professionals will work closely with you to navigate the complex process of acquiring a business. We’ll provide guidance, answer your questions, and assist you in securing the right financing.

Funding Options

We offer various funding options for business acquisition, including term loans, lines of credit, and SBA loans. You can choose the financing solution that best aligns with your goals and financial situation.

Competitive Rates

Our business acquisition loans come with competitive interest rates, helping you keep your financing costs manageable and improving the financial feasibility of your acquisition.

Funding Options for Business Acquisition

In addition to business acquisition loans, The Working Capital Marketplace provides a range of funding options to support your acquisition strategy:

SBA 7(a) Loans

These government-backed loans offer favorable terms and are an excellent choice for qualifying businesses. They can cover various acquisition costs, such as working capital, real estate, and equipment.

Term Loan

Term loans provide you with a lump sum of capital that can be used for the purchase price or other acquisition-related expenses. Repayment is made in fixed installments over a predetermined term.

Lines of Credit

Lines of credit offer flexibility by allowing you to draw funds as needed during the acquisition process. Interest is charged only on the amount you use.

Seller Financing

In some cases, the seller of the business may be willing to provide financing for the purchase. We can assist in structuring and securing seller financing arrangements.

Asset-Based Financing

If the acquisition includes valuable assets, you may be able to leverage those assets as collateral for financing, reducing the risk for lenders.

What qualifies your Company Acquisition Loans?

To get a Company Acquisition Loans, you need the following:

Minimum 12 months’ time-in-business

Minimum of 200K annual business revenue

Credit Score of 550 or higher

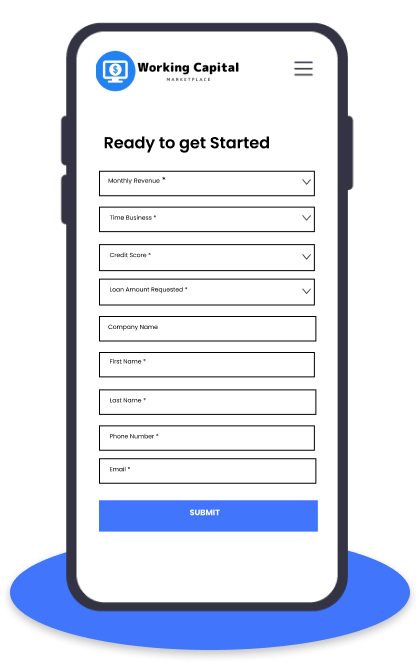

Ready to apply for Company Acquisition Loan?

Acquiring a business can be a transformative step for your entrepreneurial journey or an opportunity to expand your existing enterprise. At The Working Capital Marketplace, we offer a comprehensive suite of business acquisition loans and funding options to make your acquisition plans a reality. Our team is committed to providing you with the financial tools and expertise you need to complete a successful acquisition. Contact us today to discuss your business acquisition goals and explore the financing solutions available to you.

Apply Online

Fast & Easy Online Application Get your Quote today

Review Your Options

Get connected with a Funding Manager dedicated to you, to review and customize options.

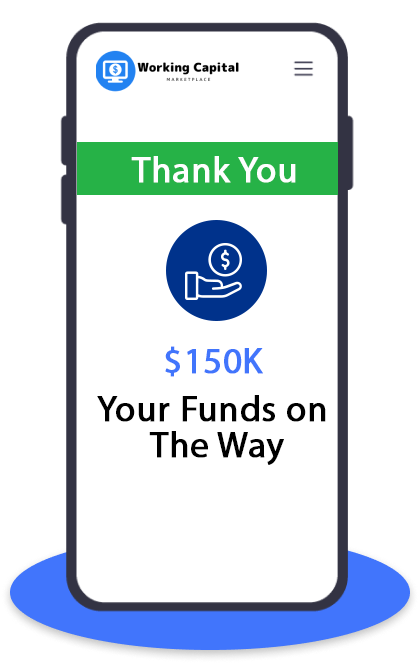

Get Funded

Your Funds will usually be sent same day viawire or ACH

Reviews

What Customers Say?