SBA Loans

Fuel Your Business Success with The Working Capital Marketplace

Unleash the Potential of Your Business with SBA Loans and the 7(a) Program

Welcome to The Working Capital Marketplace, your dedicated partner in enhancing business growth through strategic Small Business Administration (SBA) loans. Discover a world of opportunities designed to elevate your business to new heights.

5 Star Rating on Google

Why Partner with The Working Capital Marketplace?

At The Working Capital Marketplace, we specialize in providing businesses with the financial fuel they need to succeed. Explore our tailored solutions through SBA loans and the dynamic SBA 7(a) program.

Transformative Benefits of SBA Loans

SBA 7(a) Loan Program

Dive into the advantages of our featured SBA 7(a) program, offering support for diverse business needs such as working capital, equipment purchase, and more.

Flexible Financing

Experience the flexibility of our loan terms and competitive interest rates, customized to align with your unique business goals.

Strategic Business Expansion

Secure the necessary funds to expand your operations, explore new markets, and increase the impact of your business.

Empowered Working Capital

Ensure seamless day-to-day operations with the working capital needed to cover essential expenses.

Unveiling the Power of SBA 7(a) Loan Program

What Sets the SBA 7(a) Loan Program Apart?

The SBA 7(a) program is a versatile financing option that caters to various business needs. Here’s why it’s a game-changer:

Generous Loan Amounts

Benefit from SBA 7(a) loans that can range up to $5 million, providing substantial financial support

Flexible Use of Funds

Utilize funds for working capital, debt refinancing, equipment purchase, and more, adapting to your business requirements.

Government Guarantee

Enjoy a government guarantee that reduces risk for lenders, making it easier for businesses to secure funding.

Addressing Challenges with Innovative Solutions

Ample Collateral Options

The Working Capital Marketplace understands that collateral can be a concern. Our SBA loans, including the 7(a) program, often require less collateral than traditional loans, expanding accessibility.

Credit History Expertise

We specialize in working with businesses with varying credit histories, ensuring financial solutions for all.

Navigate the SBA 7(a) Loan Application Process

Our expert team simplifies the application process for SBA 7(a) loans. Key requirements include:

Comprehensive Business Plan

Financial Statements

Personal and Business Tax Returns

Collateral Information

SBA 7(a) Loan Application

Are we a match? Check our business term loan requirements.**

1 Year

in business

625

personal FICO® score

$100K

business annual revenue

Business

Business Checking Account

Let’s Propel Your Business Together!

Ready to explore the vast potential of SBA loans, particularly the 7(a) program, with The Working Capital Marketplace? Connect with our experts today to discuss your business goals, address any concerns, and embark on a journey toward sustainable growth.

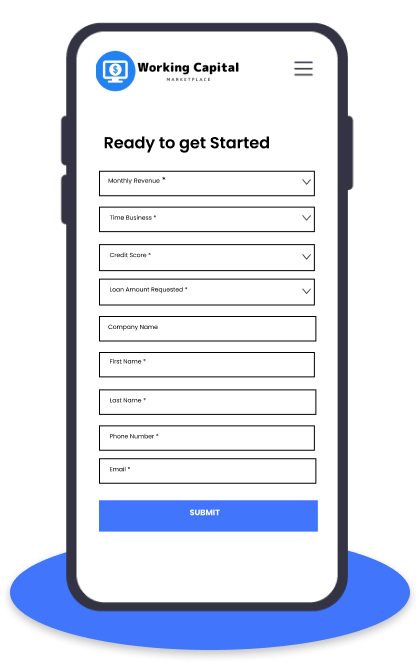

Apply Online

Fast & Easy Online Application Get your Quote today

Review Your Options

Get connected with a Funding Manager dedicated to you, to review and customize options.

Get Funded

Your Funds will usually be sent same day viawire or ACH

Reviews

What Customers Say?

FAQ’s

Which businesses are eligible for SBA 7(a) loans through The Working Capital Marketplace?

The SBA 7(a) program caters to a broad spectrum of businesses, from startups to established enterprises, offering financing for various purposes.

How long does it take to get approval for an SBA 7(a) loan with The Working Capital Marketplace?

The approval timeline varies, typically ranging from a few weeks to a few months. Our dedicated team ensures a smooth and efficient process.

Can the SBA 7(a) loan from The Working Capital Marketplace be used for debt consolidation?

Yes, the flexibility of the 7(a) program allows for debt consolidation, providing a comprehensive solution for businesses.