Business Term Loans

Business loans are a fundamental financial tool that can provide your company with the capital it needs to grow, thrive, and achieve its goals. Whether you’re a startup looking to get off the ground, an established business seeking expansion, or simply need additional working capital, understanding business loans can be a crucial step in your financial strategy.

5 Star Rating on Google

What is a Business Loan?

A business loan is a financial arrangement in which a lender provides your company with a sum of money that is repaid over time with interest. These loans come in various forms, each designed to meet specific business needs. The funds obtained from a business loan can be used for a wide range of purposes, including:

Emergency Funds

Prepare for unexpected expenses or economic downturns.

Expansion

Open new locations, invest in equipment, or grow your product or service offerings.

Debt Consolidation

Refinance existing debt to lower interest rates and simplify repayments.

Business Opportunities

Seize new opportunities, take advantage of bulk purchasing discounts, or launch marketing campaigns.

Working Capital

Cover everyday expenses such as payroll, inventory, and operational costs.

Why Are Business Loans Useful?

Business loans offer several advantages that can be invaluable for your company’s growth and stability:

Access to Capital

Secure the necessary funds to support your business initiatives without depleting your working capital.

Financial Flexibility

Tailor your loan to match your specific needs, whether short-term or long-term, large or small.

Interest Deductions

In many cases, the interest on business loans is tax-deductible, potentially reducing your overall tax liability.

Build Credit

Responsible borrowing and timely repayments can help improve your business credit score, making it easier to access future financing.

Requirements to Qualify for Funding

While specific eligibility criteria may vary depending on the lender and the type of loan, there are common factors that lenders consider when evaluating loan applications:

Creditworthiness

Your personal and business credit scores play a significant role in the approval process.

Business Financials

Lenders may review your company’s financial statements, including income statements, balance sheets, and cash flow projections.

Collateral

Some loans may require collateral, such as real estate, inventory, or equipment, to secure the loan.

Business Plan

A well-structured business plan that outlines your objectives and how you plan to use the funds can strengthen your application.

Repayment Ability

Lenders assess your ability to repay the loan based on your business’s current and projected cash flow.

Industry and Market

Your business’s industry, market conditions, and growth potential may influence loan approval.

Types of Business Loans

Business loans come in various forms, including:

Term Loans: A lump sum of capital with fixed interest rates and a set repayment schedule.

Lines of Credit: Access to a revolving credit line that can be drawn upon as needed.

SBA Loans: Government-backed loans with favorable terms for small businesses.

Equipment Financing: Financing for purchasing or leasing business equipment.

Merchant Cash Advances: Advances based on future credit card sales.

Invoice Financing: Advances on unpaid invoices to improve cash flow.

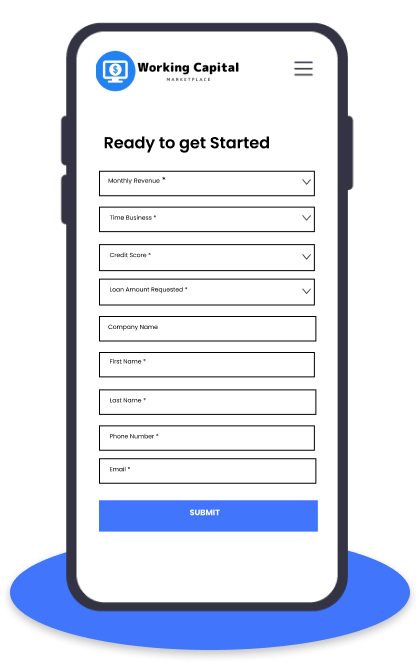

Apply In 2 Minutes

Decision As Fast As 5 Hours

Get Funded As Fast As

24 Hours

Receive Between

$25,000 – $6,000,000

Need a Fast

Business Loan?

$5K – $2M NO PERSONAL GUARANTEE

"*" indicates required fields

Ready to Apply for a Business Term Loan?

Business loans are a versatile financial tool that can help your company achieve its objectives, whether you’re looking to expand, cover operational expenses, or seize new opportunities. Before applying for a business loan, carefully evaluate your needs, explore the various loan options available, and work with lenders who understand your specific industry and financial requirements. With the right loan and a solid financial strategy, your business can thrive and reach new heights.

Apply Online

Fast & Easy Online Application

Review Your Options

Get connected with a Funding Manager dedicated to you, to review and customize options.

Get Funded

Your Funds will usually be sent same day viawire or ACH

Reviews

What Customers Say?